Medicare Basics: Eligibility, Parts A–D, Costs & How to Choose

New to Medicare? This concise guide explains who’s eligible, how the different parts work (A, B, C, D), what you might pay, and how to pick coverage that fits your health needs and budget. It’s general information—not financial or medical advice. For official rules, always confirm with Social Security and Medicare.gov.

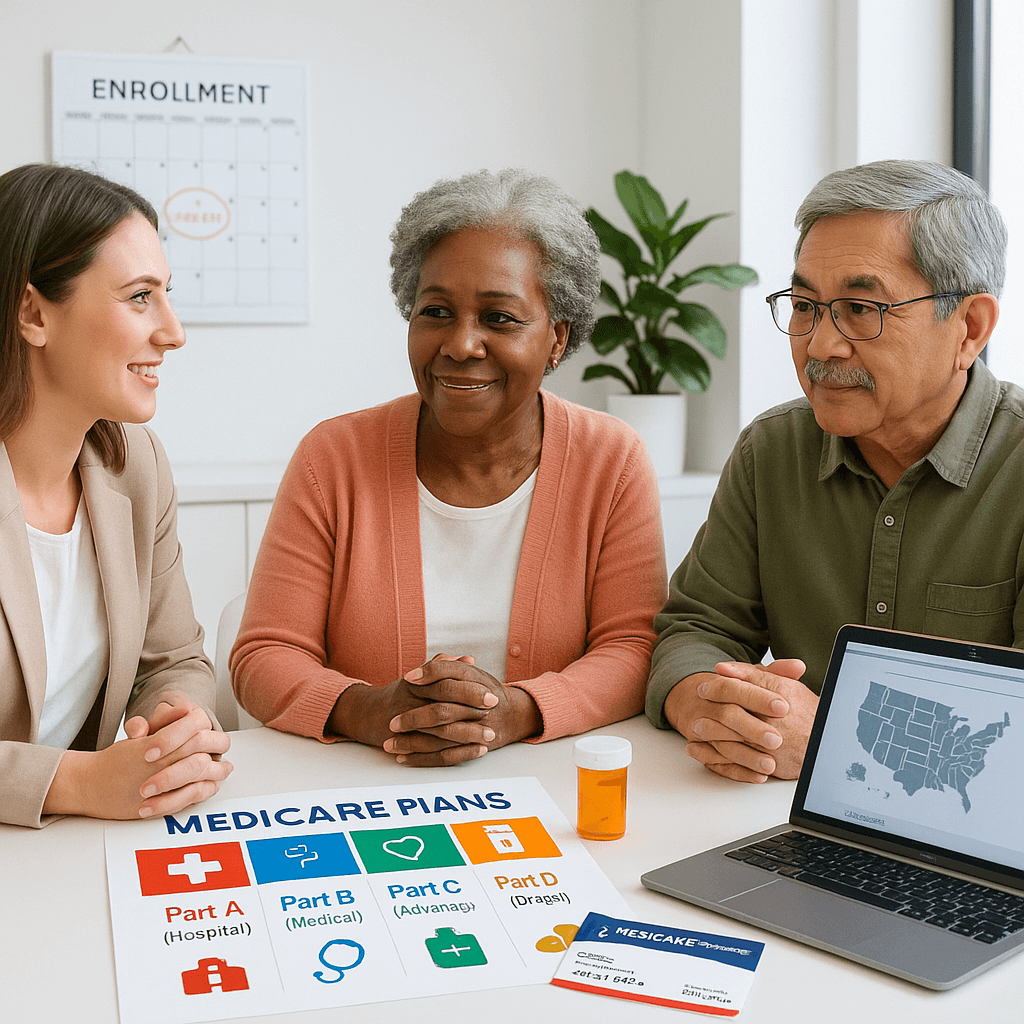

What Is Medicare?

- Federal health insurance primarily for people 65+, and some younger people with certain disabilities or ESRD/ALS.

- Part A (Hospital): Inpatient care, skilled nursing facility, some home health and hospice.

- Part B (Medical): Doctor visits, outpatient care, preventive services, durable medical equipment.

- Part C (Medicare Advantage): Private plans that bundle Parts A & B (often Part D) with extra benefits.

- Part D (Drugs): Prescription drug coverage via private plans.

Eligibility & When to Enroll

- At 65: You’re typically eligible if you or your spouse worked and paid Medicare taxes long enough.

- Initial Enrollment Period (IEP): 7-month window—starts 3 months before the month you turn 65, includes your birth month, and ends 3 months after.

- Special Enrollment Periods (SEP): For qualifying life events (e.g., losing employer coverage).

- General Enrollment Period (GEP): If you miss IEP/SEP, you can enroll annually (may face a late penalty).

Original Medicare vs. Medicare Advantage

- Original (A & B): See any provider that accepts Medicare; add Part D for drugs; consider Medigap to help with deductibles/coinsurance.

- Medicare Advantage (Part C): Managed by private insurers; networks (HMO/PPO), out-of-pocket maximums, and often extras (vision, dental, hearing, fitness).

- Key decision: Flexibility and nationwide access (Original) vs. bundled benefits and a single ID card (Advantage).

Prescription Drugs (Part D)

- Formularies vary: Check that your medications are covered and at what tier.

- Pharmacy networks & mail order: Can affect cost and convenience.

- Annual review: Plans and drug lists change; compare each year.

Medigap (Medicare Supplement)

- Helps pay some out-of-pocket costs (deductibles, coinsurance) with Original Medicare.

- Standardized plans (e.g., Plan G) with different premiums and coverage details.

- Best time to buy is often your Medigap open enrollment (you can’t be denied for health reasons then).

What You Might Pay

- Premiums: Part B has a monthly premium; Part A may be premium-free if you have enough work credits; Part C/D/Medigap premiums vary by plan.

- Deductibles & copays/coinsurance: Vary by part/plan and can change each year.

- Ways to save: See if you qualify for Extra Help (Part D) or a Medicare Savings Program based on income/resources.

How to Choose

- List your meds and doctors—ensure they’re covered/in-network.

- Estimate total annual costs (premiums + expected copays + deductibles).

- Consider travel needs (Original may offer broader nationwide access).

- Review extras you care about (dental, vision, hearing, fitness, OTC).

- Re-shop plans during open enrollment; needs and plans change.

Medicare Plan Resources (Ads):

Conclusion

Start with your doctors and medications, estimate total yearly costs, and decide whether you want the flexibility of Original Medicare or the extras of Medicare Advantage. Revisit your coverage during open enrollment each year to keep your plan aligned with your needs.